Market Recap

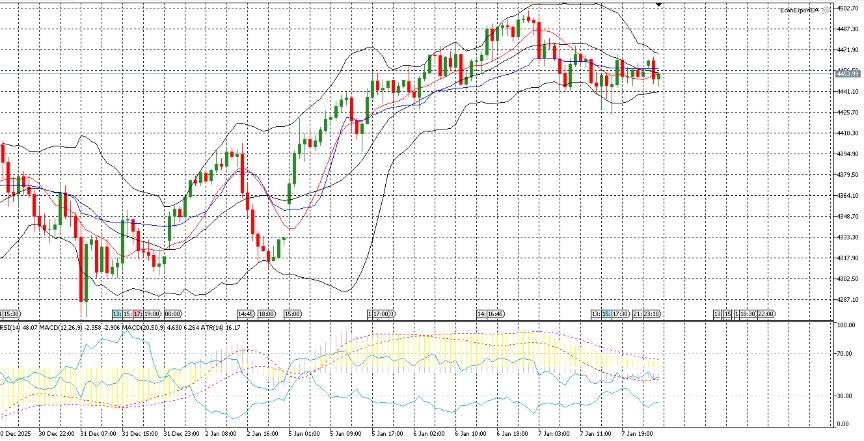

XAUUSD

XAUUSD opened at 4495.91 and printed the session high at 4500.58 at 01:27, marking a new 5‑day peak and briefly trading above the 4500 round figure. Price then retraced and extended lower into the afternoon, reaching the session low at 4423.49 at 17:18, with the trough set within the 4400 handle. The day closed at 4455.63, a decline of 40.28 points or 0.896% from the open, leaving the settlement in the lower half of the intraday range. The high‑to‑low span was 77.09 points, equivalent to 1.71% of the opening level, and the path of trade traversed multiple 10‑point handles from the 4500s into the 4400s. The close positioned the market roughly mid‑way between the low and the midpoint of the range and about 45 points below the peak. On the intraday trend backdrop, the settlement sat marginally below the H1 21‑EMA at 4457.84. Round‑number levels featured prominently, with an early test above 4500 followed by price action anchored in the 4400s later in the session. From a higher‑timeframe lens, daily momentum indicators showed D1 RSI(14) at 59.27, while the high at 4500.58 matched the current 5‑day extreme. The sequence for the day was a quick early high, a steady descent into a late‑afternoon low, and a partial recovery into the close without retesting the day’s peak.

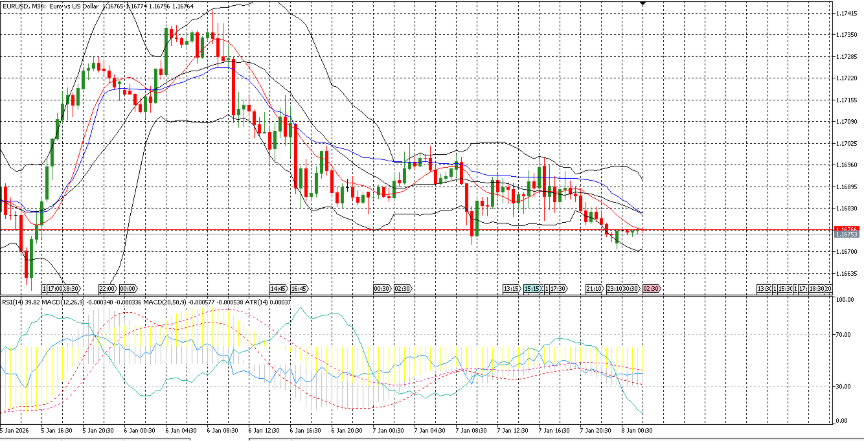

EURUSD

EURUSD ended the session higher, settling at 1.17, up 0.0008 or 0.07% from the 1.17 open. Price traveled 0.0021 on the day, equivalent to 0.18% of the open, with the low marked at 00:00 and the high printed at 04:13. The session began with the trough at 00:00, progressed upward into the early-morning peak at 04:13, and finished closer to the top of the range than the bottom. Trading remained centered on the 1.17 figure, with a brief move above that handle into the high before easing into the close. The close sits in the upper portion of the intraday span, indicating the session concluded nearer resistance than support defined by the day’s extremes. In the broader context, spot is above the 50‑day simple moving average near 1.16, while the daily MACD signal is at 0.0. A 10‑day high at 1.18 remains untested in this window, leaving recent multi‑session resistance levels unchanged. No daily ATR reference was provided for comparison, and there were no tick volume figures. Overall structure showed the low set at the start of trade, a sequence of higher prints into the 04:13 high, and a final mark that retained a portion of the intraday gains while remaining within the 1.17 handle.

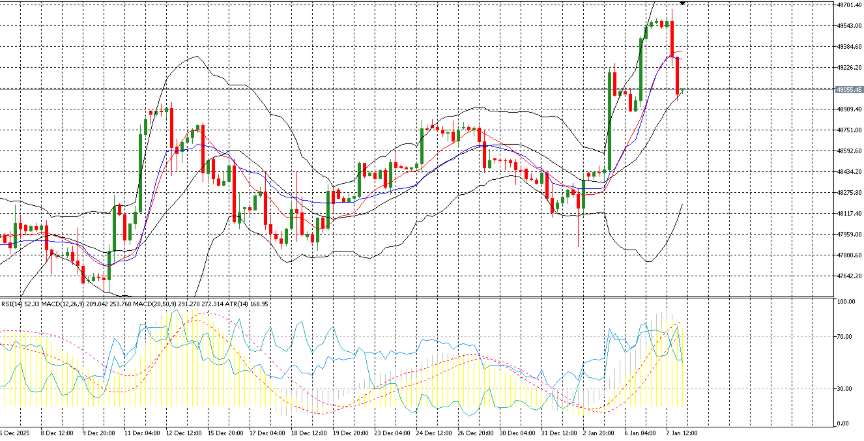

US30

US30 marked a new short-term peak before fading into the close, setting the session high at 49,666.45 at 16:31 and the low at 48,973.45 at 23:18, then settling at 49,023.15. From the 49,535.5 open, it finished down 512.35 points (-1.03%), with a 693-point intraday range that equated to 1.4% of the opening level. The high registered both a 5‑day and 10‑day high, while the close landed 49.7 points above the session low and 23.15 points above the 49,000 round figure after price briefly traded below that level late in the session. The day’s sequence saw an early extension from the open into the 49,600s, the peak printed just past the U.S. cash open, and a steady push lower into the final hour, leaving the settlement near the bottom of the day’s range. Round-number dynamics were in focus, with the intraday move spanning the 49,600s down through 49,000, and the market ending just above that handle. On the daily timeframe, price remains above the 50‑day simple moving average at 47,802.61, while the 14‑day RSI stands at 66.07 and MACD is positive at 368.58. The session’s range was moderate relative to the open, and the close location underscores the late-session pressure despite the earlier multi‑day high. By the close, DJ30 was anchored near the lower tail of the day’s profile, having traversed from a new recent high to a finish just past 49,000.

Economic Calendar Recap & Preview

A sharp rebound in US private hiring and steady services momentum anchored the latest data: ADP Nonfarm Employment Change rose to 41.0 from -31.0, far above the 3.0 forecast, while the ISM Non‑Manufacturing PMI printed 54.4, signaling continued expansion; its prices‑paid gauge was 64.3. Energy data added a supportive demand/supply mix as EIA crude inventories fell 3.83 million, deeper than both the prior 1.93 million draw and the 1.74 million decline expected. Looking ahead, at 12:00 server time the euro area Consumer Price Expectations are seen easing to 22.2 after 23.1 previously, offering a read on households’ inflation views. The US calendar then features Initial Jobless Claims at 15:30 server time, with consensus at 226.0 versus 199.0 prior; a lower‑than‑forecast outcome would imply a still‑firm labor market, which could temper expectations for early policy easing. No major policy meetings are scheduled, but claims can still jar rate and FX markets, particularly following the upside ADP surprise.