Market Recap

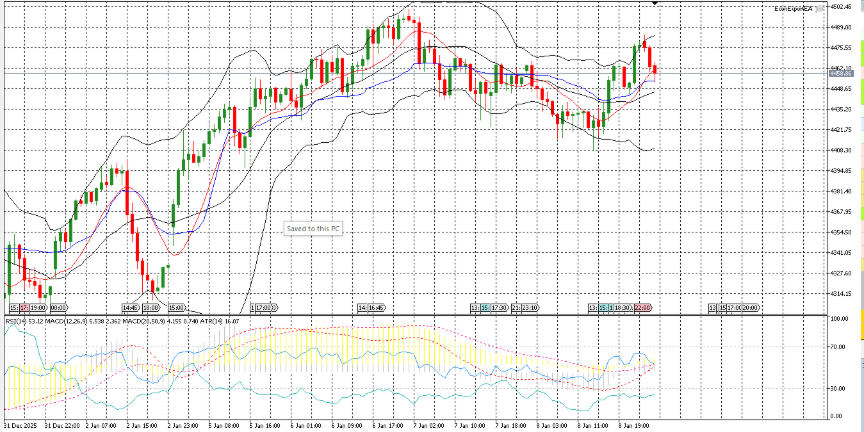

XAUUSD

XAUUSD ended the 08 Jan session at 4477.3, up 17.02 or 0.382% from the open, after traversing a 71.87 range that equated to 1.61% of the opening price and sat below the D1 ATR14 of 90.5. The market opened at 4460.28 and initially softened, pressing toward the 4400 handle before marking the intraday low at 4407.7 at 14:16. From there, price retraced higher through the latter part of the session, reaching the day’s high at 4479.57 at 23:10 and settling only 2.3 points beneath that peak, leaving the close near the top of the day’s range. The day’s extremes were contained within the 4400s hundred-handle band, with the high set in the 4470s and the low probing the lower reaches of that bracket near 4400. In terms of session structure, the sequence featured a decline from the open into early afternoon, followed by a steady climb into the final hour, with no subsequent breach of the late high before the 23:57 close. On higher timeframes, daily volatility context showed the session’s realized move smaller than the prevailing 14-day average range, while the daily MACD signal registered at 67.95. On the intraday side, the H1 RSI14 printed 72.59 during the session. With the finish close to the session high and well above the mid-point of the day’s span, price action concluded with upward momentum into the close while remaining within the 4400 handle throughout.

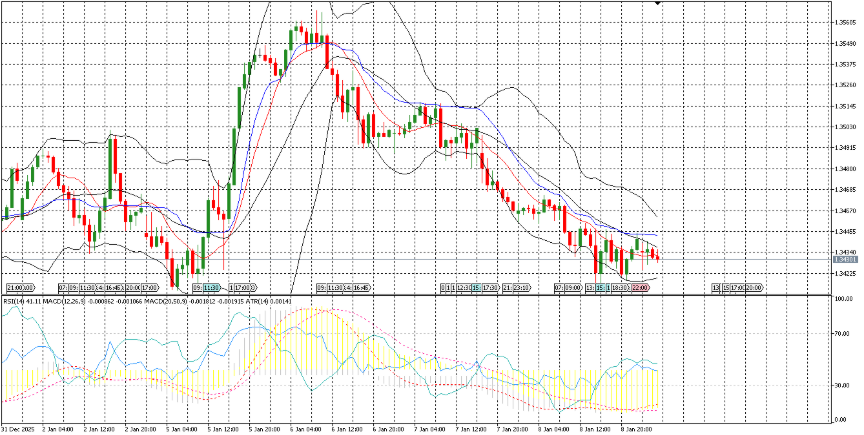

GBPUSD

GBPUSD eased over the session, settling at 1.34 by the 00:00 close, a decline of 0.0023 or 0.17% from the prior open. Price opened at 1.35 and marked the day’s high at 1.35 at 05:32 before slipping steadily into the afternoon to register the low at 1.34 at 15:53. The day’s range measured 0.005, equating to 0.37% of the opening level, and the close fell in the lower half of that span, closer to the low than the high. After the early uptick, subsequent rebounding was limited, with the pair ending 0.0018 above the session low and 0.0032 below the high. Round-number areas framed the action: the early high stayed below 1.35 on a closing basis, while intraday weakness remained above the 1.34 handle. On the intraday technical backdrop, the H4 50-period simple moving average was situated near 1.35 (1.34794), remaining above price throughout the session, and the H1 20-period simple moving average was near 1.34 (1.34407), with the final print below that reference. On the daily timeframe, momentum signals were muted, with the MACD line at 0.00 and its signal line at 0.01. Overall, the session sketched an early high followed by an afternoon low and a modest recovery into the close, leaving price contained within the mid-1.34s and finishing nearer the lower end of the day’s distribution.

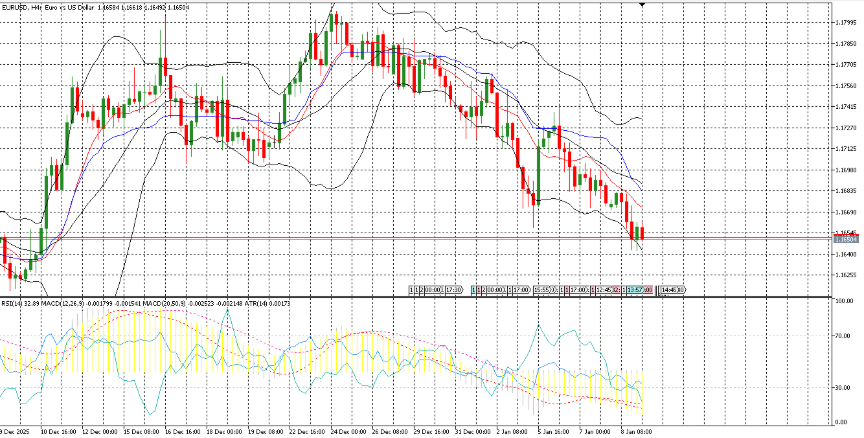

EURUSD

EURUSD eased over the session, finishing at 1.16529 after opening at 1.16725 for a net decline of 0.00196 (-0.168%). Price marked the intraday high at 1.16824 at 07:57 before sliding into the low at 1.16421 at 21:01, which registered both a 5-day and a 10-day low. The day’s range measured 0.00403, equal to 0.35% of the open, and the close sat in the lower third of that span. Price action was capped below the 1.17 handle throughout, while the late-session dip briefly pushed through 1.165 before a modest recovery into the close. The close remained just under the daily Bollinger midpoint at 1.16622, with the upper band at 1.18085 well overhead, and it held above the 50-day simple moving average at 1.16415, with the session low testing that vicinity. On the intraday backdrop, the pair settled beneath the H1 20-period simple moving average at 1.16665. Momentum on the H4 timeframe was soft, with RSI(14) at 29.37 by the end of the window. Structurally, the session established its peak early in the European morning and then progressively traced lower levels into late U.S. hours, leaving the settlement closer to the day’s floor than its top. By the close, EURUSD had retraced most of the early uptick from the open and remained confined within a relatively contained range, with round-number interest centered on 1.165 and 1.17 shaping intraday references.

Economic Calendar Recap & Preview

Markets digested mixed signals: US initial jobless claims increased to 208k from 199k, coming in below the 226k forecast, while euro area consumer price expectations jumped to 26.7 from 23.1, exceeding the 22.2 forecast. The focus now shifts to Friday’s US labor report at 15:30 server time. Nonfarm Payrolls are expected at 100k after 64k previously, and the unemployment rate is seen at 4.8 percent, up from 4.6 percent. A stronger-than-forecast payrolls number could firm expectations for a less accommodative policy stance. No major central bank events are scheduled alongside the release, but markets typically key off payrolls breadth, revisions, and participation metrics in addition to the headline jobs and unemployment figures. Given the concentration of releases at 15:30, short‑term volatility in rates, equities, and the dollar is a risk around the print.