Market Recap

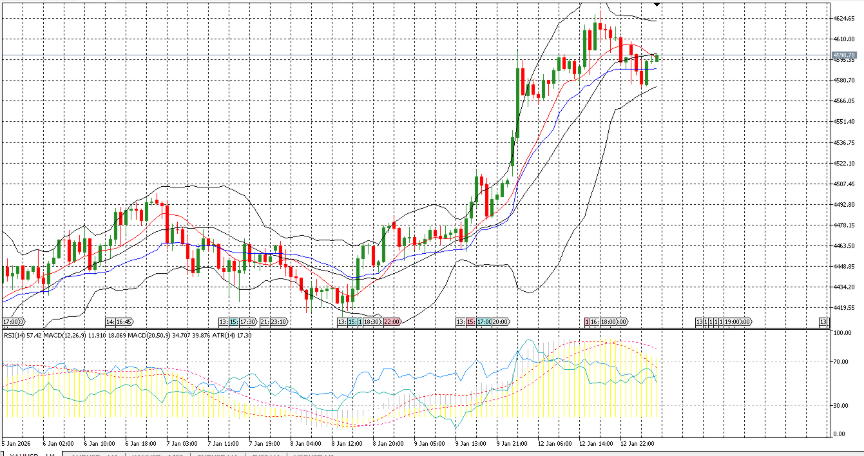

XAUUSD

XAUUSD closed higher on 2026-01-12 at 23:57, settling at 4596.85, a gain of 76.56 or 1.694% from the session open. Trading began at 01:00 at 4520.29, with the day’s low posted a minute later at 4512.75 at 01:01, and the high set much later at 4630.2 at 18:18. The intraday range measured 117.45 points, equal to 2.6% of the opening price, and the close occurred nearer the top of that span. Price action featured a pass through a 100-handle threshold, with the 4600 round figure recorded intraday and subsequently exceeded en route to the session peak, before easing back to finish 33.35 points below the high and well above the session floor. The session registered fresh 5-day and 10-day highs, while the 10-day low remains marked at 4274.64. On intraday indicators, H1 RSI(14) read 53.62 and H4 MACD stood at 43.24. Structurally, the sequence saw an immediate early dip establishing the day’s low, followed by a broad advance into the afternoon and a late-session high at 18:18; into the final hour, price held above the 4600 level and concluded the session closer to the high than the low. From start to finish, the market traversed 4512.75–4630.2 and returned to end at 4596.85, encapsulating a 117.45-point session that included a test and clear of the 4600 handle within the broader climb.

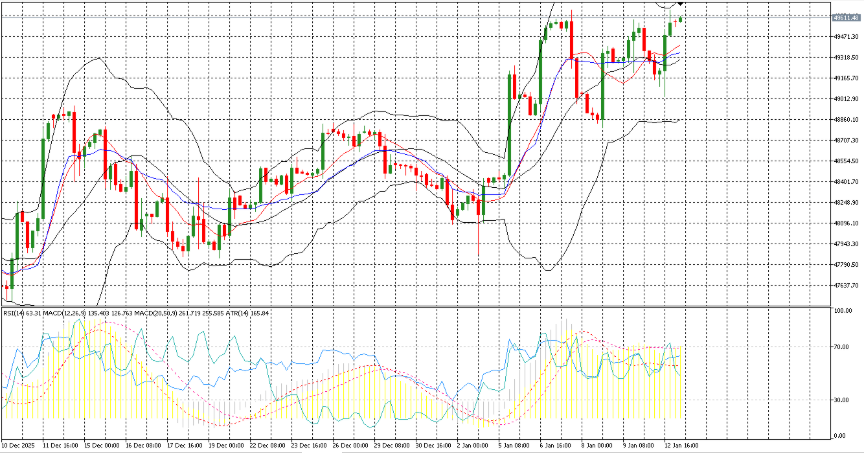

US30

US30 ended the 12 Jan session at 49,571.15, up 36.15 points or 0.07% from the 49,535.0 open. Price traversed a 640-point intraday span, equal to 1.29% of the open, setting the day’s low at 49,025.45 at 16:35 and the high at 49,665.45 at 22:53. The close was 94 points below the high and 546 points above the low, placing it in the upper quartile of the session’s range and slightly below the 49,600 area. From the open, the market moved about 510 points lower into the afternoon trough before recovering to trade roughly 130 points above the opening level into the late-session peak, stopping short of 49,700. Round-number levels featured through the day: price dipped to within 26 points of the 49,000 handle without breaking it and later reclaimed and oscillated around 49,500, finishing back above that threshold. On higher timeframes, the close sat above the H1 20-period SMA at 49,353.26 and the H4 21-period EMA at 49,312.31, and remained north of the D1 Bollinger midline at 48,710.91. Daily momentum gauges were elevated, with D1 RSI(14) at 67.31, while the D1 MACD signal line registered 390.69. Overall, the session opened near the upper third of the eventual range, extended sharply lower by mid-afternoon, then advanced into a late high at 22:53 before settling in the upper portion of the day’s distribution, modestly above the open and below the intraday top.

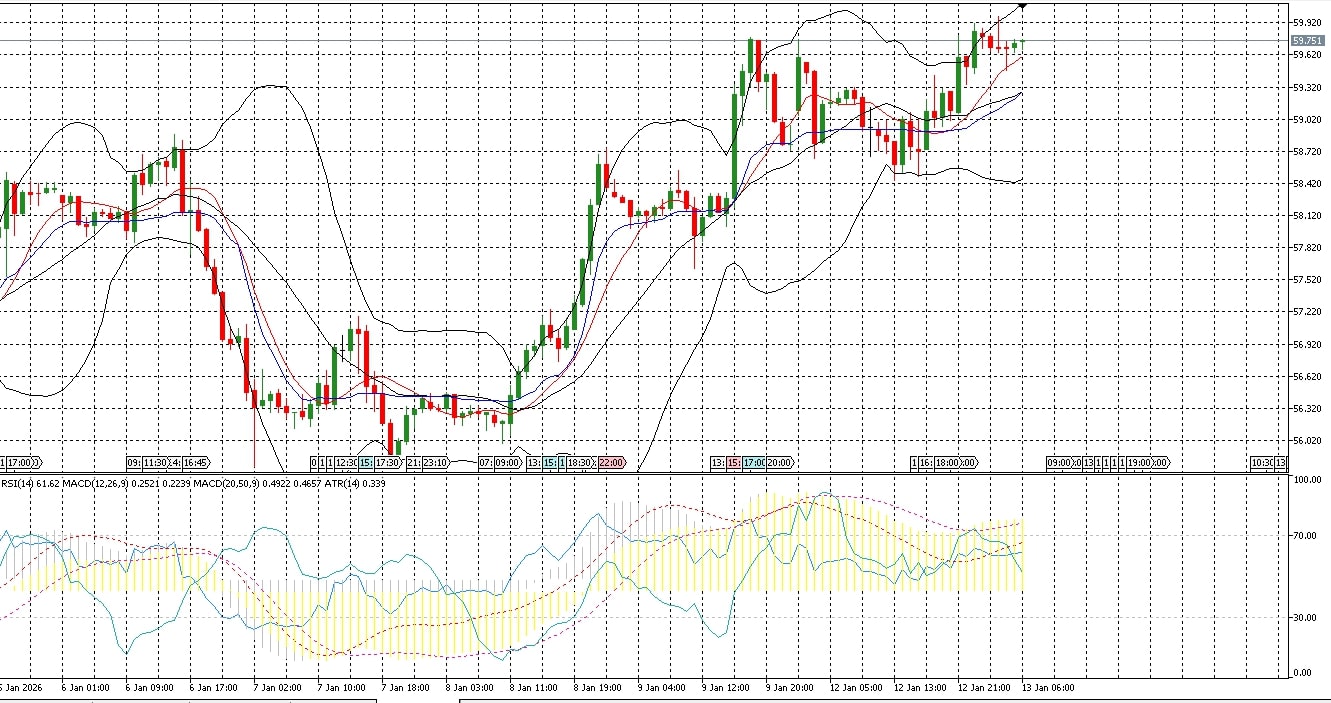

USOIL

USOIL closed at 59.84, up 0.74 on the day for a 1.24% gain, after a 1.46 intraday span equal to 2.48% of the open. The session opened at 59.10, slipped to the low at 58.44 by 13:23, then advanced through the New York afternoon and set the high at 59.91 at 23:48, finishing 0.07 below that mark and leaving the close near the top of the day’s range. The path featured an early fade into the low, followed by steady upside into late trade, with price regaining and holding above 59.00 and approaching the 60.00 handle without printing it. On the higher timeframes, the day’s action remained above the daily Bollinger mid at 57.63, while the prevailing 10‑day low stands at 55.78. The session registered fresh 5‑day and 10‑day highs, aligning the late push with multi‑session resistance milestones, while the intraday low kept the market above the 58.00 round level. By the close, positioning within the range was skewed to the upper end, reflecting a recovery from the midday trough into a late-session peak set minutes before the bell. No tick volume data were provided. Overall, the trading day spanned the upper 58s to the high 59s, with the final print consolidating just below the intraday high and within reach of the 60.00 figure, and with daily context anchored above the 57.63 Bollinger mid and well clear of the 10‑day floor at 55.78.

Economic Calendar Recap & Preview

U.S. Treasury supply was steady, with the 10‑Year Note auction clearing at 4.17 percent, matching the prior 4.17 percent. Looking ahead, at 11:00 server time Bank of England Governor Andrew Bailey speaks; while not a data release, his remarks could shape sterling and UK rate expectations. The main focus is the U.S. inflation report at 15:30: CPI month over month and core CPI month over month are due alongside the headline CPI year over year, which is expected to hold at 2.7 percent after 2.7 previously. If CPI prints above forecast, basic textbook dynamics suggest expectations for tighter policy, or a slower pace of prospective easing, may firm. A brief flurry of volatility is possible around the CPI release across rates, FX, and equity futures. No other major data are scheduled in the window, leaving the inflation print and Bailey’s appearance as the primary catalysts for price action through the session; traders will parse the breadth of inflation, especially the core month over month detail, for any signs of stickiness in services relative to goods, while the unchanged year over year consensus anchors the headline narrative heading into the New York morning.