Central banks are among the most closely watched institutions in the financial world. Their policies, decisions, and even simple statements can significantly move markets—affecting currencies, stocks, bonds, and commodities.

For anyone participating in the financial market, understanding central banks is essential. But what exactly is a central bank, and why does it matter so much? Let’s break it down.

1. What is a Central Bank?

A central bank is a national institution responsible for managing a country’s monetary policy, which includes overseeing the currency, controlling interest rates, and regulating the money supply.

Unlike commercial banks, central banks do not serve individual customers. Instead, their primary role is to maintain economic stability through policy decisions that support long-term growth and financial security.

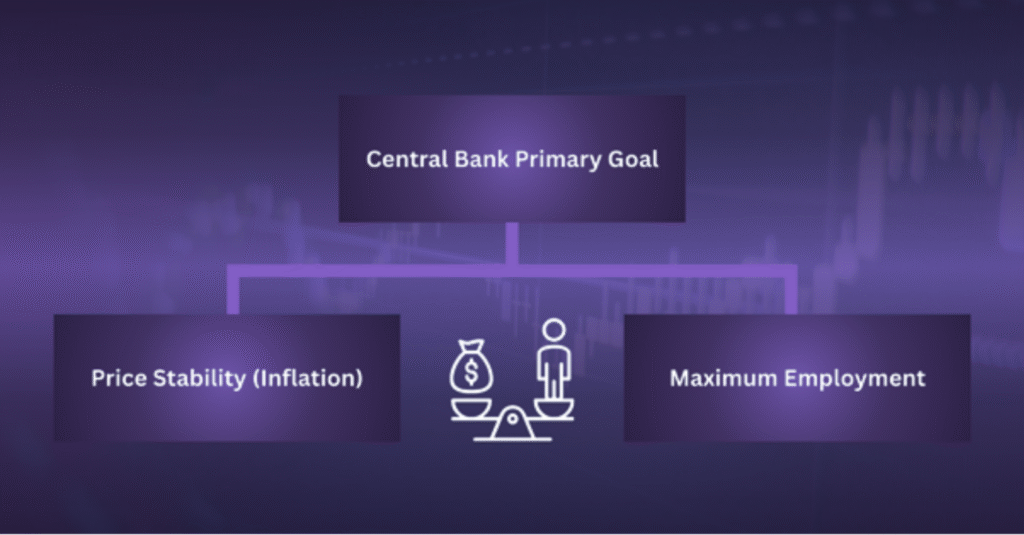

Across most economies, central banks focus on several core objectives:

- Maintaining price stability (controlling inflation)

- Maximizing employment

- Ensuring currency stability

- Overseeing and regulating the financial system

Among these, the two key mandates in many regions—especially for central banks like the Federal Reserve—are price stability and maximum employment. By achieving these goals, central banks help create a stable environment for businesses, consumers, and investors alike.

2. Major Central Banks in Financial Markets

In the financial market, traders and investors closely monitor several key central banks around the world. These institutions play a vital role because their policy decisions often have a significant impact on the global economy and financial markets.

Typically, these central banks are from countries whose currencies are heavily traded and widely used in global finance. The most closely watched central banks include:

| Central Bank | Country/Region | Currency |

| European Central Bank(ECB) | Eurozone | EUR |

| Bank of England(BoE) | United Kingdom | GBP |

| Bank of Japan(BoJ) | Japan | JPY |

| Swiss National Bank(SNB) | Switzerland | CHF |

| Reserve Bank of Australia(RBA) | Australia | AUD |

| Bank of Canada(BoC) | Canada | CAD |

| People’s Bank of China(PBoC) | China | CNY |

3. What is Monetary Policy

As mentioned earlier, one of the key responsibilities of a central bank is managing a country’s monetary policy.

Monetary policy refers to the tools and actions used by a central bank to control the money supply, inflation, and interest rates in an economy.

By adjusting these factors, central banks aim to keep the economy stable—supporting growth during slowdowns and cooling it down when inflation runs too high.

There are two main actions in monetary policy:

3.1. Tightening Monetary Policy

This is when a central bank raises interest rates or reduces the money supply to slow down an overheating economy or bring down inflation.

- Often leads to stronger currency

- Can slow down borrowing, spending, and investment

- Typically used when inflation is rising too fast

3.2. Easing Monetary Policy

This is when a central bank lowers interest rates or increases the money supply to stimulate economic activity.

- Often leads to weaker currency

- Encourages borrowing and spending

- Used during periods of weak growth or economic downturn

Through monetary policy, central banks primarily control their benchmark interest rates—such as the Federal Funds Rate for the Federal Reserve or the Loan Prime Rate (LPR) for the People’s Bank of China.

By adjusting these rates, central banks influence the flow of money in the economy, which in turn impacts economic activity, inflation, borrowing costs, and consumer spending.

4. How Central Bank Impact Financial Market

Central banks play a big role in the financial market because they control how much money flows through the economy. When they make changes—especially to interest rates—markets react.

Here’s how it works in simple terms:

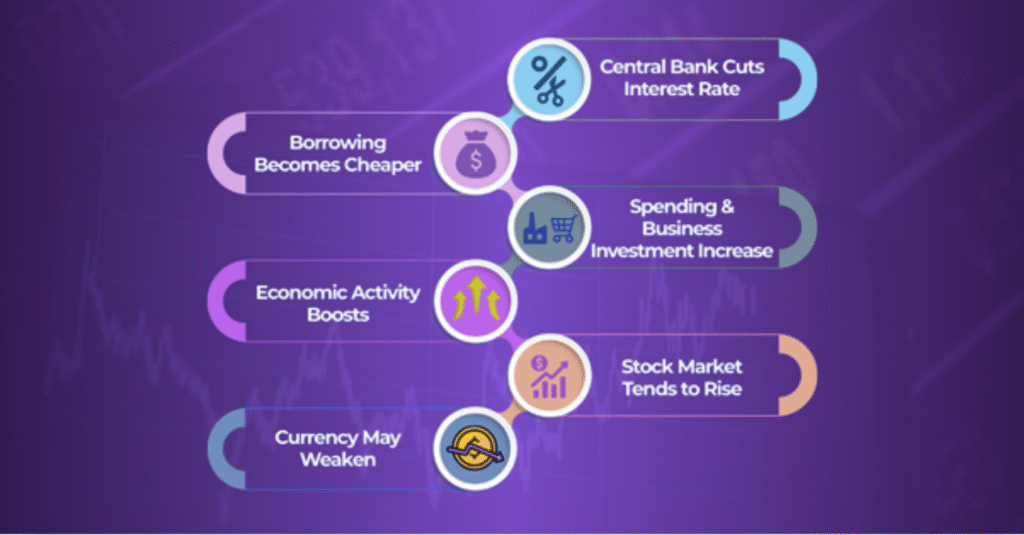

When a central bank cuts interest rates (easing policy), it makes borrowing cheaper, which encourages more spending and investment. This helps boost economic growth and often supports a rising stock market, while the currency may weaken because lower rates are less attractive to foreign investors.

On the other hand, when a central bank raises interest rates (tightening policy), borrowing becomes more expensive, leading to less spending and slower growth. This can put pressure on the stock market, but the currency may strengthen due to higher returns for investors.

In short:

- Lower rates = more money in the system = good for stocks, weaker currency

- Higher rates = less money in the system = bad for stocks, stronger currency

This is why traders always watch central bank meetings—they help predict where the market might go next.

5. Forward Guidance & Central Bank Communication

Beyond actual policy moves, central banks significantly influence markets through their statement and central bank stance—a concept known as forward guidance. This involves providing signals about the likely future path of interest rates and monetary policy, which allows markets and investors to adjust expectations in advance.

Central bank officials—including governors and committee members—regularly deliver speeches, issue policy statements, publish meeting minutes, and hold press conferences. Traders closely analyze the language, tone, and choice of words in these communications to assess whether the central bank is leaning toward tightening (raising rates) or easing (cutting rates) in the future.

Here are two commonly used terms in central bank communication:

- Hawkish: Indicates a preference for tightening policy (raising rates to fight inflation). This often supports a stronger currency and may lead to weakness in stock and bond markets.

- Dovish: Suggests an inclination toward easing policy (lowering rates to support growth). This may weaken the currency but support equities and risk assets.

Even when a central bank keeps interest rates unchanged, markets can move sharply if forward guidance changes. For example:

- If a central bank hints that inflation risks are rising and rates may be increased sooner, the currency may strengthen immediately—even before any actual rate hike.

- Conversely, if a central bank unexpectedly signals a more cautious stance, risk assets like stocks and gold may rally while the domestic currency falls.

Understanding forward guidance helps traders anticipate future market conditions and align their strategies with shifting monetary expectations.

6. Final Thought

Central banks are more than just institutions adjusting interest rates—they are the backbone of economic stability and a major driving force behind global financial market movements. From shaping monetary policy to guiding market expectations through forward guidance, their influence is far-reaching and continuous.

For traders and investors, understanding how central banks operate—and more importantly, how markets react to their decisions and communication—is essential. It allows you to better anticipate volatility, adjust your strategies accordingly, and position yourself ahead of potential market moves.

While you may not be able to predict every rate decision or statement tone, developing a solid grasp of central bank behavior equips you with one of the most powerful tools in financial analysis: macro awareness. Combined with technical and risk management skills, this knowledge can elevate your decision-making in trading Forex, commodities, indices, or any macro-sensitive asset class.

In short, follow the banks, follow the money—because the market certainly does.