1. What Is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is one of the most important economic indicators used to measure inflation—the rate at which prices for goods and services increase over time. It reflects the average change in prices that consumers pay for a fixed basket of everyday items, including food, housing, transportation, energy, and medical care.

In simple terms, the CPI tells us whether the cost of living is rising or falling, helping us understand how inflation affects consumer purchasing power.

1.1 Why Is CPI Important?

CPI is not just a measure of inflation—it plays a crucial role in shaping economic and financial decisions across the board:

- It helps central banks evaluate inflation trends and guide monetary policy, such as raising or lowering interest rates.

- It serves as a reference for governments when adjusting wages, tax brackets, and social benefits like pensions.

- It provides investors and financial markets with key insights into the health of the economy, helping them anticipate policy changes and make informed investment decisions.

Because of its wide impact, CPI is closely watched by policymakers, analysts, and traders around the world.

2.How Is CPI Calculated?

The Consumer Price Index (CPI) is calculated by comparing the cost of a fixed “basket” of goods and services in the current period with the cost of that same basket during a base period. The formula is:

This basket represents a range of items that households typically buy—such as food, rent, transportation, healthcare, and more. The idea is to track how the overall cost of living changes over time.

But what exactly goes into this basket? That depends on the country. Each nation builds its CPI basket based on local household spending patterns to ensure it accurately reflects consumer behavior.

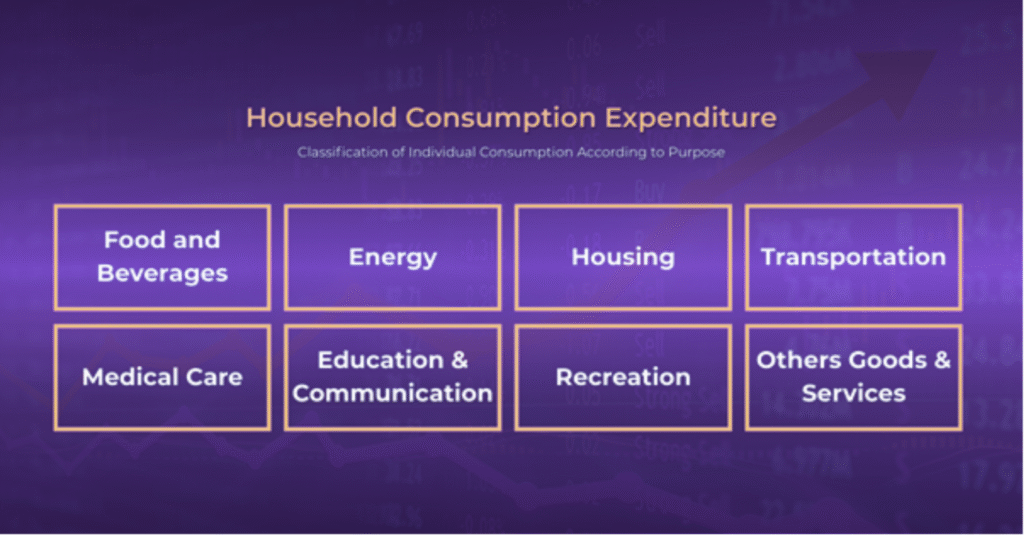

For example, in the United States, the CPI basket covers over 200 categories, grouped into eight major sectors:

3. What Is Core CPI?

When discussing CPI, you’ll often come across Core CPI—a more refined version of the Consumer Price Index.

Core CPI excludes two of the most volatile components: food and energy. These prices tend to fluctuate due to seasonal patterns or external shocks, such as oil price spikes or weather-related disruptions.

By removing these unstable elements, Core CPI gives a clearer picture of underlying, long-term inflation trends.

This is why central banks pay closer attention to Core CPI when evaluating inflation risks and making monetary policy decisions. It reflects the more persistent price pressures in the economy.

4. How Does CPI Affect Financial Markets?

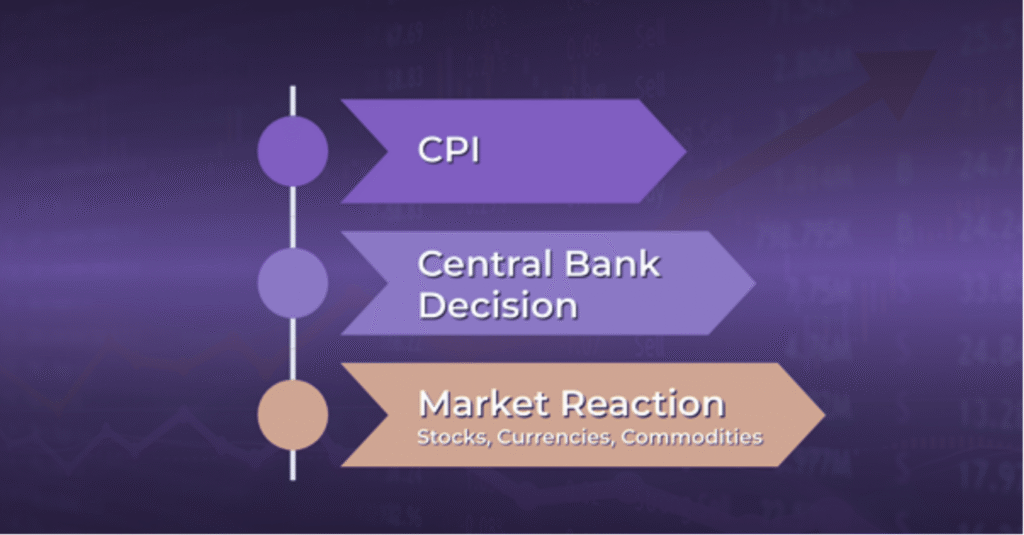

In financial markets, CPI often causes volatility, but it’s important to note that it doesn’t directly move the market. Instead, the market reacts to how central banks respond to CPI data.

The Consumer Price Index plays a key role in shaping interest rate decisions. When inflation is too high or too low, central banks may adjust rates accordingly—and these changes are what truly drive movements in stocks, currencies, and commodities.

Here’s how it works:

- When CPI Rises (Higher Inflation): Central banks may raise interest rates to slow down inflation (tightening policy)

- When CPI Falls (Low Inflation or Deflation): Central banks may lower interest rates or introduce stimulus measures (easing policy)

| Higher interest rates | Lower interest rates |

| Strengthen the currency (e.g., USD) Slow economic growth Weigh on stock markets and commodity prices | Weaken the currency Encourage borrowing and spending Support stock and commodity prices |

Simply put, the Consumer Price Index (CPI) influences how central banks adjust monetary policy, which in turn has a significant impact on financial markets. As a result, CPI is often viewed as a key indicator for predicting central bank policy decisions that could move the market volatility.

5. How to Read a CPI Report?

Now that we understand how the CPI report can influence financial markets, learning how to read it effectively can give traders and investors an edge in anticipating market movements.

Most countries release CPI data on a monthly basis, typically showing two key figures:

5.1. CPI Year-over-Year (YoY):

This compares the current month’s CPI to the same month one year ago.

- Example: If June 2025 CPI is 3.2% YoY, it means prices are 3.2% higher than in June 2024.

- YoY is the most commonly cited figure in headlines and market reactions.

5.2. Month-over-Month (MoM):

This compares the CPI from one month to the previous month.

- Example: If CPI rose 0.4% MoM in June, it means prices increased by 0.4% compared to May.

- MoM helps identify short-term trends or turning points.

6. CPI Impact: Context Matters

It’s important for traders and investors to remember:

A higher CPI reading doesn’t always mean a currency will strengthen, and a lower CPI doesn’t always mean it will weaken.

The market’s reaction to CPI data often depends on the broader economic context, policy expectations, and investor sentiment at the time of release.

Real-World Example: U.S. Inflation in 2022

In June 2022, U.S. CPI soared to 9.1% year-over-year (YoY)—the highest inflation rate in over four decades.

This unexpectedly strong reading led markets to rapidly price in more aggressive rate hikes from the Federal Reserve.

In response, the Fed delivered a series of large interest rate increases to cool down the overheating economy. The impact was immediate:

The moves have led to:

- A sharp appreciation in the U.S. dollar

- A sharp correction in the stock market

- A shift in global capital flows amid of higher yields and risk-aversion.

This case illustrates how CPI can act as a key driver of central bank policy and market direction—but its impact is never in isolation.

The market response always hinges on context, expectations, and whether the data surprises or confirms existing forecasts.

7. Final Thought: Why CPI Matters for Every Market Participant

Whether you’re a trader, investor, policymaker, or just someone trying to make sense of the economy, understanding the Consumer Price Index (CPI) is essential. It’s more than just a number—it’s a key signal of economic health and a driver of central bank decisions that ripple through every asset class.

By learning how to interpret CPI data—and placing it in the right economic context—you gain a powerful tool to anticipate market moves, manage risk, and make more informed decisions.

As inflation continues to shape the global economic landscape, staying on top of CPI trends will remain critical. In a world of uncertainty, understanding inflation means understanding the pulse of the market.