Trading Contracts for Difference (CFDs) can offer high returns with relatively low capital outlay—but it also carries significant risk, especially when it comes to margin. One of the most important concepts CFD traders need to understand is margin call risk.

In this article, we’ll break down what margin is, why margin calls occur, and how you can avoid them to manage your trading account more effectively.

What is Margin in CFDs?

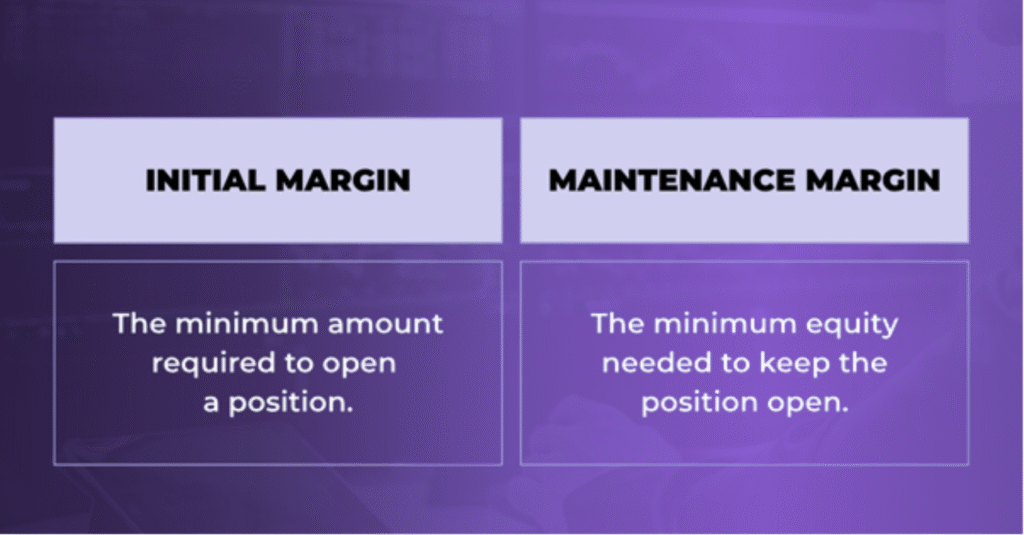

Margin in CFD trading is the amount of money trader needs deposit to open and maintain a leveraged position. It acts as collateral to cover potential losses. Put it simple, when trading on margin, you are essentially borrowing funds from your broker to control a larger position than your capital would allow.

There are two main types of margins—Initial margin and Maintenance Margin.

For example, if a broker requires a 5% margin, you only need $500 to open a $10,000 position.

Why Do Margin Calls Occur?

A margin call occurs when your account equity falls below the broker’s required margin. This usually happens due to:

- Adverse price movements in the market.

- High leverage amplifying small losses.

- Insufficient funds in the account to cover unrealized losses.

When your account equity is too low to support open positions, the broker may either request you to deposit more funds or begin closing your positions automatically—forced liquidation.

Margin Terminology in Forex & CFDs

Forced liquidation—when your broker closes positions due to insufficient margin—can be frustrating and costly.

To avoid a margin call and the risk of forced liquidation, it’s crucial to first understand the key margin-related terms. These terms are the foundation of risk management in CFD and forex trading:

- Free Margin: The available equity in your account to open new trades.

- Used Margin: The portion of your funds currently being used to maintain open positions.

- Equity: Account balance including unrealized profits or losses.

- Leverage: The ratio that amplifies your trading size (e.g., 1:100).

- Margin Requirement: The percentage of a position’s value that must be held as margin.

- Margin level: This percentage shows the health of your trading account. A margin level below a certain threshold (e.g., 100% or 50%) may trigger a margin call or automatic liquidation.

Understanding Margin Level

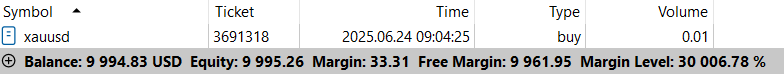

Among all margin-related terms, margin level is one of the most crucial indicators for avoiding a margin call. It reflects the overall health of your trading account and your ability to maintain open positions.

MARGIN LEVEAL FORMULA

Margin Level = (Equity ➗Used Margin) X 100

This percentage shows how much equity you have relative to the margin currently being used:

- A margin level above 100% means you have more equity than the required margin. Your positions are considered safe, and there is no immediate risk of a margin call.

- A margin level below 100% suggests your equity is less than the used margin. This may trigger a margin call, depending on your broker’s policy.

Most brokers have specific margin call and stop-out levels:

- At 100% margin level, brokers may issue a margin call warning, asking you to deposit additional funds or close some positions.

- If the margin level drops further, often to 50% or lower, brokers may start forced liquidation, automatically closing your positions to prevent further losses.

How to Avoid a Margin Call

Avoiding a margin call is essential for long-term success in CFD and forex trading. It is also a fundamental aspect of sound risk management. A margin call can lead to the forced closure of positions and significant losses—something every trader should strive to avoid.

Here are four key strategies to help you manage your account effectively and reduce the risk of a margin call:

1. Use Lower Leverage

While leverage allows traders to control larger positions with smaller capital, it also magnifies both gains and losses. Using lower leverage provides your trades with more breathing room, especially during periods of high volatility.

Remember: Leverage is a tool to enhance capital efficiency, not to overexpose your account. Responsible use of leverage can help you avoid sudden liquidation.

2. Monitor Your Margin Level Closely

Keeping a close eye on your margin level is critical, particularly during major economic releases or market-moving events. Most trading platforms display real-time margin metrics and may allow you to set alerts when your margin level approaches key thresholds.

3. Implement Stop-Loss Orders

A well-placed stop-loss order is one of the most effective tools to control risk. By defining your maximum acceptable loss per trade, you can prevent unexpected market swings from significantly depleting your equity.

Setting stop-loss levels not only protects individual trades but also helps preserve overall account balance—reducing the risk of margin calls.

4. Avoid Overleveraging and Overtrading

Opening too many positions simultaneously can stretch your margin too thin. This leaves little room for market fluctuations and increases the likelihood of triggering a margin call.

Maintain a balanced trading portfolio and ensure that you always have sufficient free margin available to support your trades.

Final Thoughts on Margin Call

In margin trading, protecting your capital is just as important as seeking profit. By applying these strategies—lower leverage, active margin monitoring, stop-loss discipline, and avoiding overexposure—you can trade more sustainably and reduce the risk of forced liquidation.