The SPX500 is one of the most popular ways for traders to gain exposure to the S&P 500 Index—a benchmark representing the performance of 500 of the largest publicly traded companies in the United States. Through Contracts for Difference (CFDs), traders can speculate on the price movements of the S&P 500 without owning the actual underlying stocks.

Often referred to as SPX500, US500, or SP500, this CFD product is widely offered by brokers around the world, including ADFX, making index trading more accessible than ever before.

What Is SPX500 CFD?

The SPX500 CFD is a derivative instrument that mirrors the performance of the S&P 500 Index, allowing traders to speculate on price movements without needing to purchase or hold the actual stocks.

Unlike traditional methods of investing in the S&P 500—such as through ETFs or futures—the SPX500 CFD allows for direct trading with lower capital requirements and no ownership of physical assets.

In the CFD market, the term “US500 cash” or “SPX500 cash” may also be used, highlighting the nature of cash-settled trading where positions are settled based on price difference rather than physical delivery.

Key Features of SPX500 CFDs

As mentioned earlier, the S&P 500 Index itself is not directly tradable. Investors typically gain exposure through derivatives such as futures or ETFs. However, these traditional instruments often come with higher capital requirements, trading restrictions, and additional fees.By contrast, SPX500 CFDs offer a more flexible, accessible, and cost-efficient way to speculate on the S&P 500 Index—making them an attractive option for both beginner and experienced traders.

1. Leverage and Margin Trading

One of the key advantages of SPX500 CFDs is the ability to trade using leverage. With CFDs, traders only need to deposit a fraction of the full contract value (known as margin) to open a position.This allows for greater capital efficiency and makes S&P 500 trading more accessible to retail investors. However, it’s important to note that leverage also amplifies potential losses, so effective risk management is crucial.

2. Trade Both Bull and Bear Markets

Unlike traditional stock investing, which profits only when prices rise, SPX500 CFDs allow for two-way trading. You can take long (buy) positions when you expect the market to rise—or short (sell) positions when you anticipate a decline.

This flexibility is especially valuable in volatile or uncertain market environments, giving traders more opportunities regardless of market direction.

3. Competitive and Transparent Cost

Unlike the S&P500 Futures or ETFs, Leading brokers such as ADFX provide tight spreads on SPX500 CFDs, especially during peak U.S. trading hours. Lower spreads mean lower transaction costs, which is critical for intraday traders or scalpers aiming for quick profits.

4. Extended Trading Hours

Unlike U.S. stock exchanges with limited trading hours, most SPX500 CFD brokers offer extended or nearly 24-hour trading, Monday through Friday.

This allows global traders to respond to market news, earnings reports, and economic data in real-time—without being restricted by traditional exchange hours.

SPX500 CFDs vs S&P 500 Futures vs ETFs: A Quick Comparison

Here’s a quick side-by-side comparison to help you understand how SPX500 CFDs differ from other popular instruments like futures and ETFs:

| Feature | SPX500 CFD | S&P 500 Futures | S&P 500 ETFs |

|---|---|---|---|

| Ownership | No | No | Yes |

| Leverage | High | Low | Limited or none |

| Minimum Capital | Low | High | Moderate |

| Trading Hours | Extended (24/5) | 23+ hours | Standard exchange hours |

| Settlement | Cash-settled | Physical or cash | Physical (ETF shares) |

| Access | Easy via CFD broker | Requires futures account | Requires brokerage account |

Thanks to its flexibility and low entry barrier, SPX500 is ideal for those looking to trade the S&P 500 Index efficiently and responsively. SPX500 CFDs are suitable for:

- Day traders seeking to capitalize on short-term price movements

- Swing traders riding medium-term index trends

- Investors looking to hedge their existing U.S. equity exposure

- Global traders who want simplified access to U.S. markets without opening a U.S. brokerage account

Example: How SPX500 CFD Trading Works with ADFX

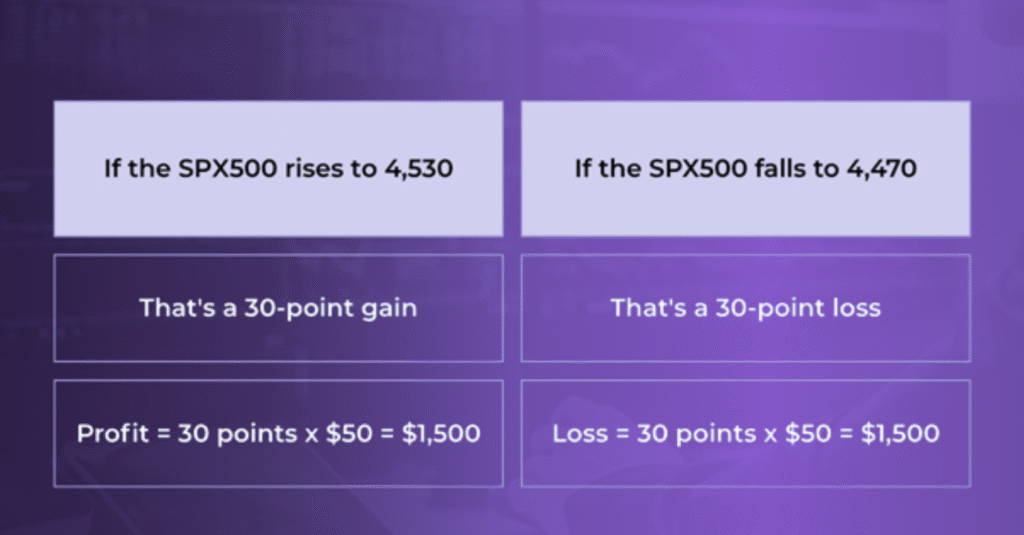

To better understand how SPX500 CFD trading works, let’s look at a simple example using ADFX contract specifications.

Scenario:

Suppose the SPX500 is trading at 4,500. You believe the market will rise, so you decide to go long (buy) 1 lot of SPX500 CFD with ADFX.

- Contract size at ADFX: 50 units per lot

- Leverage Provided: 500:1

- Margin Requirement: 0.2%

- Value Per Point: 1 point x 50 = 50

How Much Margin Do You Need?

To open 1 lot of SPX500 at 4,500:

- Contract Value = 4,500 × 50 = $225,000

- Required Margin = $225,000 × 0.2% = $450

This means you only need $450 in margin to control a position worth $225,000, thanks to the leverage offered through CFDs.

Here is how the trade scenario would be:

Flexible Position Sizes for All Traders

ADFX also offers flexible lot sizes. You can start trading with as little as 0.01 lot, which means:

- Contract Value = $2,250

- Required Margin = $2,250 × 0.2% = $4.50

You can start trading SPX500 CFDs with just $4.50, making it accessible even for beginner traders.