Market Recap

XAUUSD

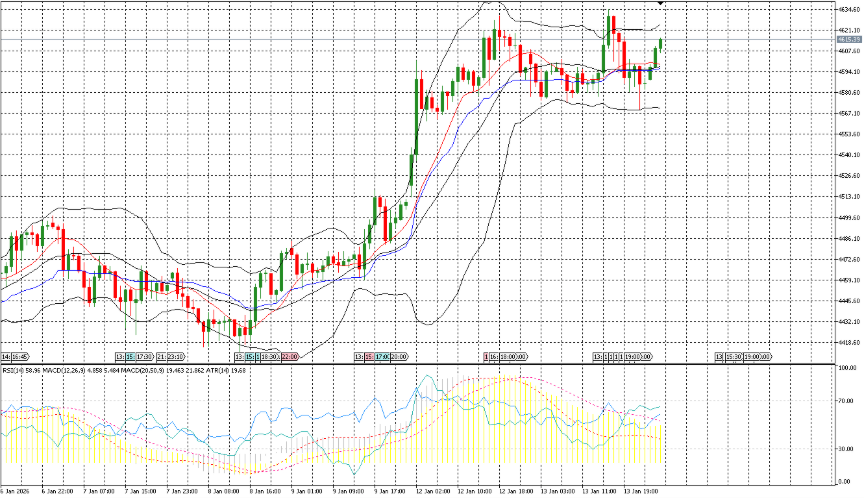

Gold (XAUUSD) reversed from a fresh short-term peak to finish lower on Tuesday. The session opened at 4605.46, pushed up to 4634.48 at 16:50, then slid to the day’s low at 4569.57 at 22:35 before settling at 4586.5, down 18.96 (-0.41%). The intraday range spanned 64.91, equal to 1.41% of the open, with the close sitting about 16.9 above the low and roughly 48.0 below the high, placing it near the lower end of the day’s distribution. Price action tested round-number interest at the 4630 handle during the high print, while the market closed 3.5 below the 4590 handle. The sequence featured strength into mid-session, marking both a 5-day and 10-day high at 16:50, followed by a late slide that extended into the final hour, with the low recorded at 22:35 and no retest of the day’s top into the close. From a higher-timeframe perspective, spot remains above the daily 50-day SMA at 4260.54 and the H4 50-SMA at 4476.65. Momentum on H4 registers a positive MACD reading at 37.75, consistent with price holding above those moving averages even as the latest session closed below the open and in the lower quartile of the day’s range. By the close, the market had faded the earlier breakout attempt toward 4630 while maintaining a wide range relative to recent opens, and finished beneath a nearby 10-handle reference at 4590.

AUDUSD

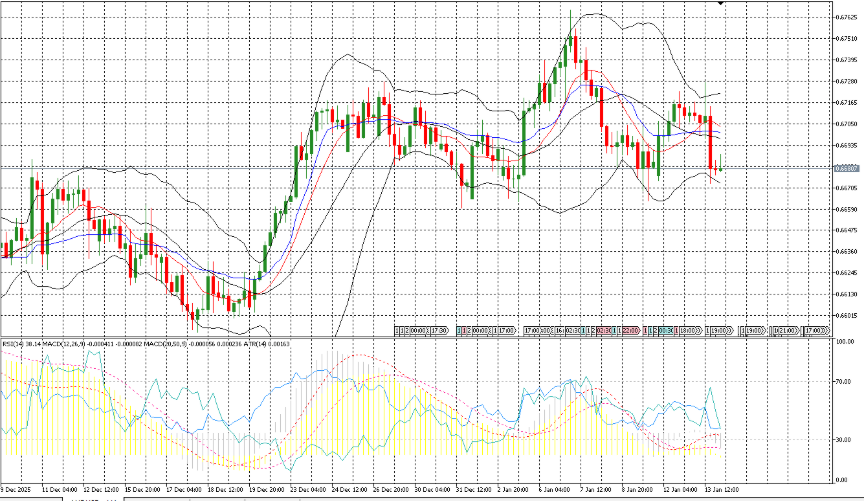

AUDUSD stayed within the 0.67 figure throughout the prior session, closing at 0.67117 for a gain of 0.00029, or 0.043%, from the 0.67088 open. Price marked the session low immediately at 00:00 at 0.67055, then worked higher into the latter part of the window to register the high at 0.67162 at 04:12, before easing slightly to finish about 4.5 pips below the peak. The session range measured 0.00107, equal to 0.16% of the open, with the close set in the upper half of the day’s span. The path featured an early dip from the open into the low, followed by a steady progression toward the high, while holding within the same 100‑pip handle and not crossing into a new big figure. Against higher‑timeframe signals, intraday prices remained above the H4 21‑EMA at 0.67024 throughout, with both the open and the session low printing above that average and the close also above it. Momentum gauges were subdued, with the H4 MACD signal sitting near 0.0 and the D1 MACD likewise around 0.0. From a structural standpoint, the pair respected levels around 0.6710 during the back half of the session and maintained distance from the 0.6700 round number after the initial dip, finishing closer to the top than the bottom of the day’s range while still below the session high set shortly before the close. No tick volume or daily ATR context was available for this window.

Economic Calendar Recap & Preview

U.S. inflation updates led the tape, with headline CPI holding at 2.7 percent year over year, matching both the prior and the 2.7 percent forecast, while the monthly profile showed CPI up 0.3 percent and core CPI rising 0.2 percent. Into the next 24 hours, Japan’s BoJ L Money Stock year over year is due at 01:50 server time and is expected at 1.8 percent after 2.1 previously, offering a read on banking-system liquidity. The main U.S. release follows at 15:30: Producer Price Index month over month is forecast to be flat at 0.0 percent after a 0.3 percent increase previously; if PPI prints higher than forecast, basic pass-through dynamics suggest inflation expectations and U.S. rate pricing may firm. At 17:30, Bank of England Deputy Governor for Markets and Banking Dave Ramsden speaks, an event that could shape sterling and gilt market expectations heading into the next policy meeting. Note that PPI often catalyzes sharp intraday moves in front-end rates and the dollar around the release.