Market Recap

XAUUSD

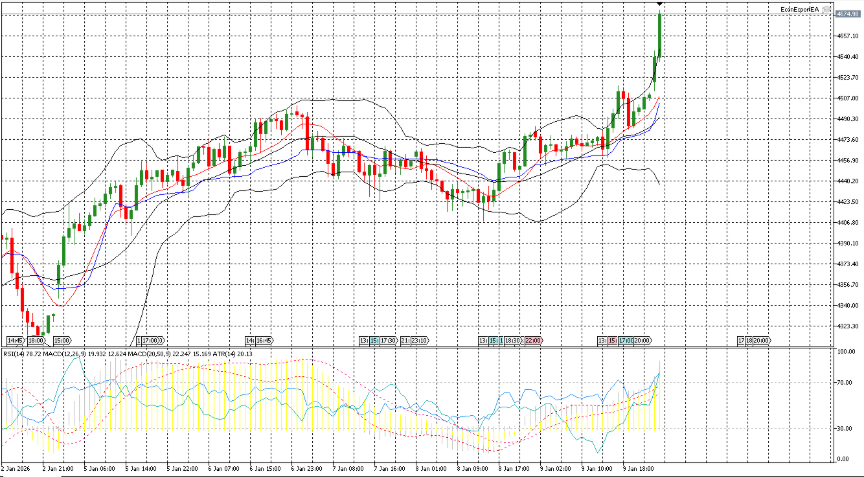

XAUUSD opened at 4479.7 at 01:00, slipped to the session low of 4452.98 by 03:08, and then worked higher into the afternoon to register the session high of 4517.2 at 17:42, which also marked a 5‑day high. It settled at 4509.4 by 23:56, up 29.7 on the day, a gain of 0.663%. The intraday span was 64.22, equal to 1.43% of the open and representing 69.2% of the D1 ATR, with the close positioned near the upper end of the day’s range. The session midpoint was 4485.09, and price finished above it. Round‑number levels featured, with trade on both sides of 4500 and a push above the 4510 figure during the high; into the close, price was 0.6 below 4510. While a 5‑day high was achieved, the move remained below the 10‑day high at 4550.03. Structurally, the day formed an early low in the first hours after the open, progressed to an afternoon high, and consolidated into the final print, leaving the close roughly 7.8 below the peak and well removed from the morning trough. On a multi‑session basis, the new 5‑day high underscores a shift in the near‑term range ceiling to 4517.2, while the 10‑day marker at 4550.03 continues to cap the broader band. Overall, the session recorded an upward daily change, an above‑midpoint close, and a range that fell short of a full D1 ATR, with price action centered in the upper quadrant of the day’s distribution.

GBPUSD

GBPUSD set fresh 5- and 10-day lows on Friday and finished weaker, closing at 1.34 for a session loss of 0.28% (about 37 pips). The day opened at 1.34 and traced a 59‑pip range, reaching the session high at 15:43 and then dropping to the low at 17:17 before stabilizing into the close at 1.34. The range represented 85% of the D1 ATR, and the close sat near the lower end of the day’s span, reflecting a late-session finish just below the 1.34 handle. Intraday structure showed an initial consolidation before a push to the high in the New York afternoon, followed by a swift move to the trough in the early evening and a modest bounce that left price parked only a few pips off the low by the close. Round-number dynamics were active around 1.34, with the market testing that level into the settlement without reclaiming it on a sustained basis. On the hourly timeframe, RSI‑14 printed near 35, consistent with a session that pressed into new multi‑day lows. From a higher‑timeframe perspective, the day’s extension to new 5‑ and 10‑day lows highlights the recent downward stretch, while the sub‑ATR range suggested movement was contained relative to the average daily amplitude. No tick‑volume figures were available. Overall, the pair spent the latter part of the session trading close to the session floor and closed beneath the 1.34 mark after a mid‑afternoon high gave way to evening weakness.

Economic Calendar Recap & Preview

Friday’s US labor report delivered a split message: Nonfarm Payrolls increased by 50k, down from 64k previously and well below the 100k consensus, while the Unemployment Rate declined to 4.4 percent from 4.6 percent previously, better than the 4.8 percent forecast. The softer payroll gain underscores a cooling in headline job creation compared with the prior month, even as the lower unemployment rate points to an improvement in the share of people without work. No other major releases were reported over the period. Looking ahead, the next 24 hours feature no scheduled economic data releases or central bank decisions on the calendar, and no notable events are expected to provide incremental direction. As a result, attention is likely to remain on digesting the latest labor figures until the calendar resumes.